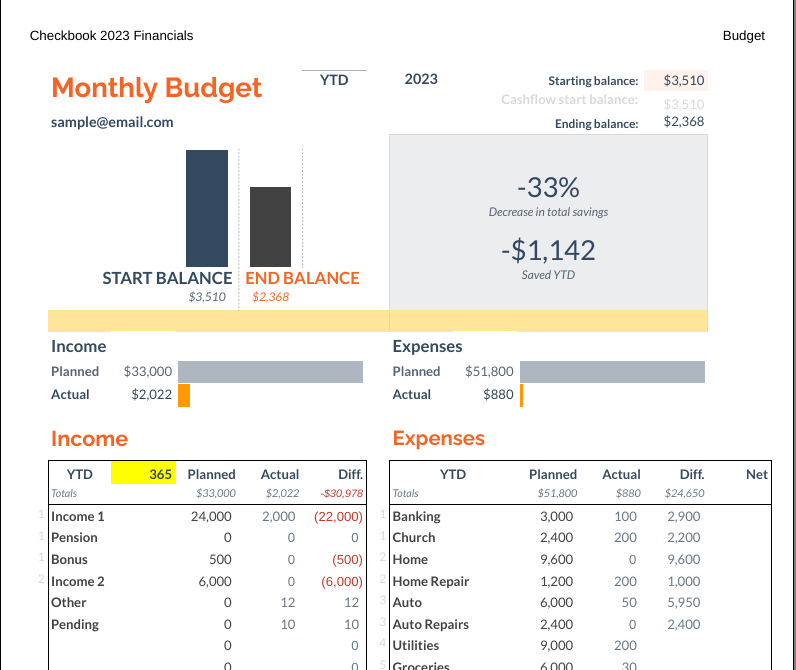

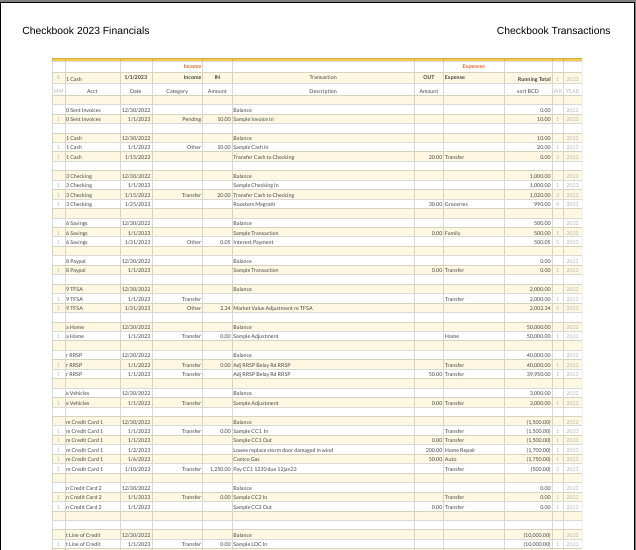

If you do a search for 'google sheets personal finance templates' you will discover 100's or even 1000's of free templates offered up. Many are more complicated. Some are more colorful. I don't know if my new offering will be of much interest, but it is what I use and I like it. Simple and effective.

The link to this sample template is found at: https://docs.google.com/spreadsheets (view only)

where you can simply 'save as copy' and start customizing it to fit your needs.

- Using it as a google sheet allows me to access and update from any computer/device/phone in the world, although a desktop computer is most convenient.

- Entering details as soon as possible allows me to remember and document the what and why .. not as much 'honey, what did we spend $xxx on three months ago?'.

- Recurring transactions are easily copied and reused .. just insert new line, copy, paste, update dates and info.

- Split transactions are fairly simple .. just add one line for each part of the split. eg 20 of 100 to Grocery and 80 of 100 to Merchandise ..

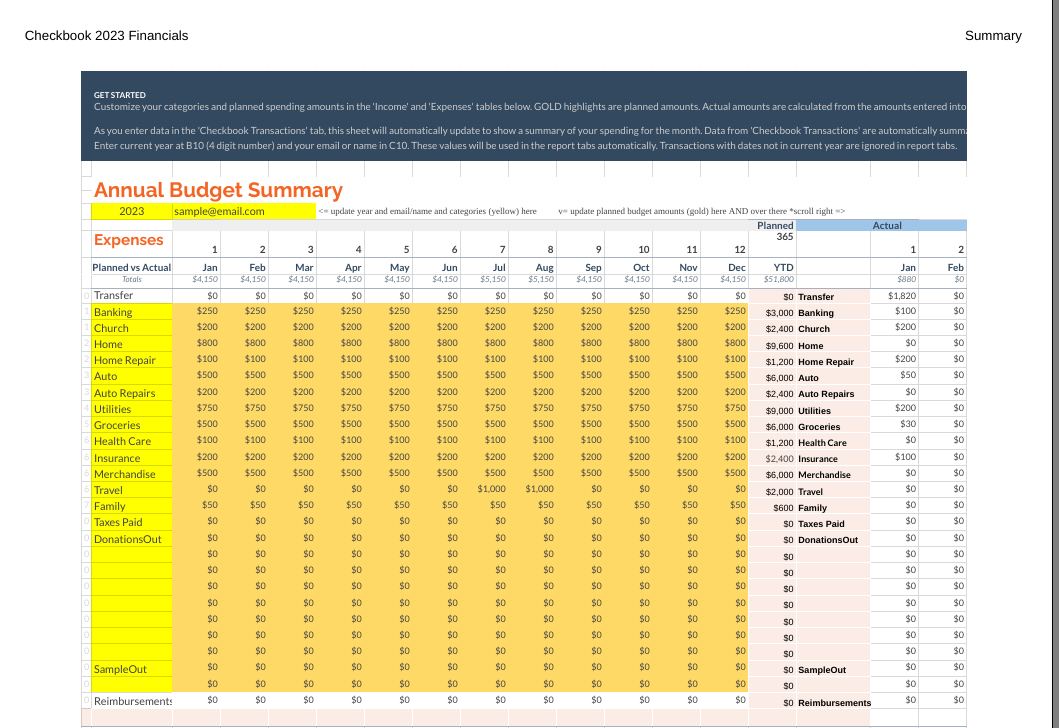

- Completely customizable - if you want 1000 expense categories, you can. If you have 100 bank accounts, you can have those tracked as well.

- Completely customizable - if you mess up .. oops. However, Google Sheets does have a nice undo/history feature that can help you un-mess-up ..

- No auto offsite backup .. although Google Cloud is backed up .. if you ever lose your Google account or credentials you may be in trouble. I like to download an offsite copy to use as a local spreadsheet backup just in case. Easy! Click File > Download > OpenDocument or Excel and save the .ods or .xlsx file to your local computer

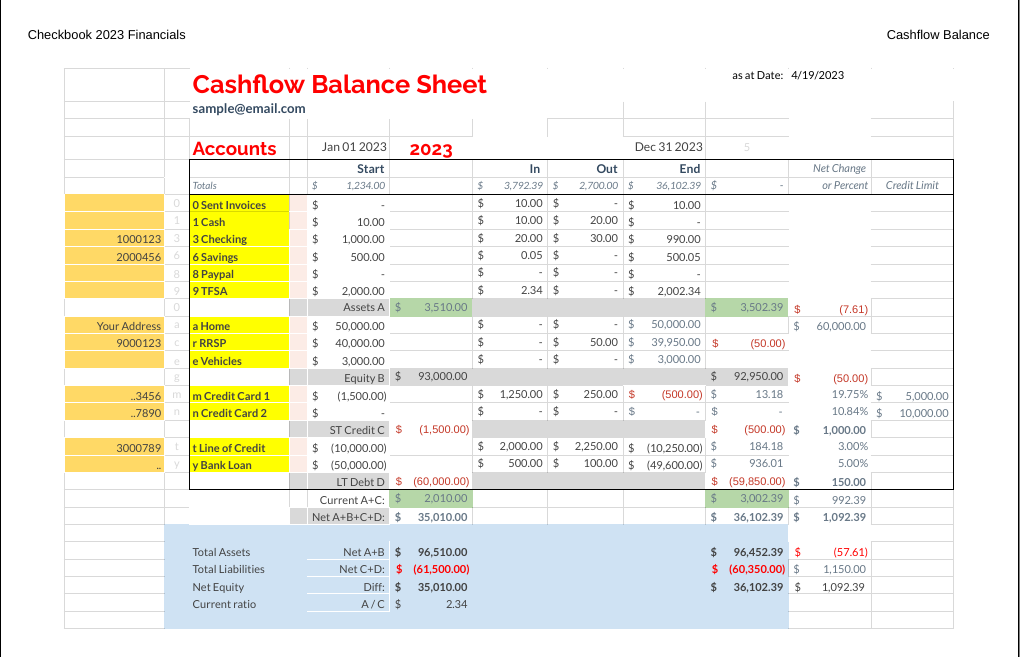

- Not a double entry system .. so as a workaround I just use the Transfer category and TWO offsetting entries for bill payments and the like eg "100 expense for Bill Payment in Checking" and "100 income for Bill Payment in Credit Card 1" with same dates .. it seems to work.

- You MAY have to learn how to use or just get around a spreadsheet - ouch

- You MIGHT get addicted to knowing just where your money is going and how much you have left!

fyi *repost* originally posted at rogerdavies.net

RSS Feed

RSS Feed