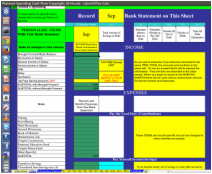

- Debt Free Spending Spreadsheet - BYU Mariott School of Management

http://personalfinance.byu.edu/content/debt-free-spending-spreadsheet

(an XLS spreadsheet and PDf document 2008) - Special thanks to Keith Russell who developed the logic and tools, and who has ...

This is where you plan your spending for the next month.

As spreadsheets go, it is quite ambitious and has a lot of calculations going on behind the scenes. If you are comfortable with using a spreadsheet you can poke around and see some of the logic built in. Otherwise, it is quite easy to use as it is. You start by selecting your language and start month and then enter in your current month balances and go from there. From the amounts you enter in month 1, the next sheet tab lists your debts by priority and suggests which should be tackled first. The next step is to enter all your expected expenses for the upcoming 12 months - vacation plans, christmas and birthday planned expenses, etc. You can revise these as needed later. Each month you enter in the amounts you received for salary and what you have spent. It calculates what is remaining and how much to save for future expenses. The spreadsheet balances turn green if you are planning correctly and red if you are doing something financially less wise and need to revise your plan. You pay down your debts one by one with the extra money you (hopefully) have at the end of each month. Eventually after debts are addressed, you save for your other goals.

Mr Russell spent some time in the session reviewing parts of the program as questions arose. He pointed out that in a family, the husband and wife must work together on the finances or else it will not work. They have to decide together their goals and be committed to the plan.

I suppose you could run his method without the spreadsheet (we were once given a binder based version of his program several years ago), but having your computer crunch the numbers is so much easier. You will likely need to use an accounting program in addition to download details from your banks and summarize you ins and outs by categories - food, clothing, utilities, etc. For this I recommend the free open source GNUCash program, free to use and works much like its pricey quickbooks cousin.

Q: How often should I record my spending?

A: Those that record the spending weekly usually stay on the program. Those that do it monthly usually drop off and stay in debt. The developer does it almost daily. It really helps to do it more often. How badly do you want to get out of debt?

That said, the discipline to only spend what you have already saved is the only way to get out of debt .. no, you are not going to win the lottery - you have to pay it back on your own - month by month. Mr Russell is to be commended for his work and insight into his methods. An amazing amount of work has been put into this worksheet and I feel the principles and information it tries to encapsulate are worthy. Now I have to go and tell my wife ..

references:

Libreoffice - www.libreoffice.org

GNUCash - www. gnucash.org

BYU Marriott School of Management Personal Finance - personalfinance.byu.edu

Keith Russell spreadsheet 2014 version PDF instructions and XLS spreadsheet*

RSS Feed

RSS Feed